net investment income tax 2021 form

Updated for tax year 2021 october 16 2021 0235 am. Investment interest expense paid or accrued in 2021.

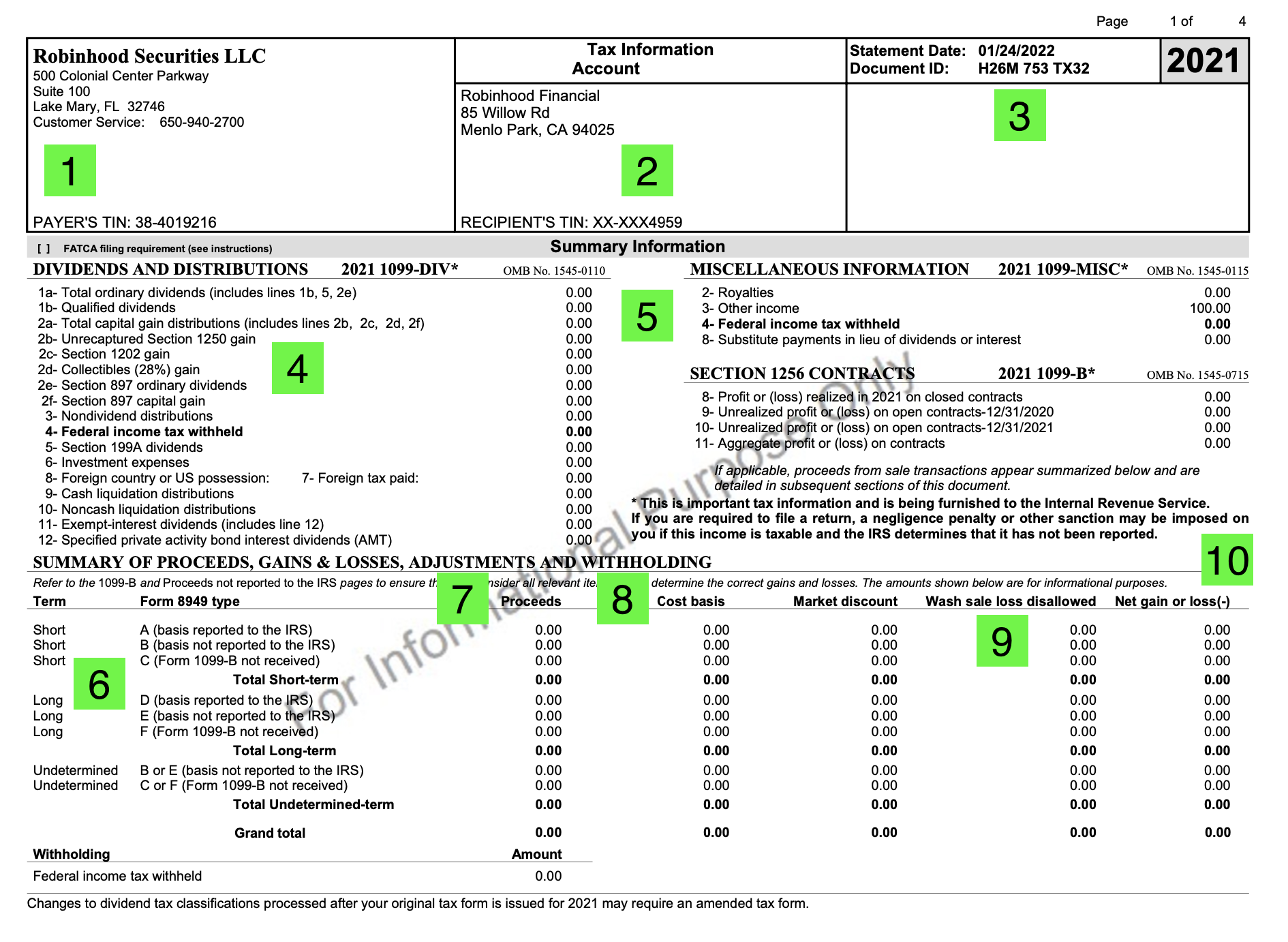

How To Read Your Brokerage 1099 Tax Form Youtube

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

. The 38 Net Investment Income Tax. Since 2013 certain higher-income individuals have been. Your net investment income is less than your MAGI overage.

Youll owe the 38 tax. Names as shown on tax return. Your wages and self-employment earnings by themselves have no impact on the NIIT.

You can download or print current or past-year PDFs of Form 8960 directly from TaxFormFinder. Tax more commonly referred to as the net investment. The applicable threshold amount is based on your filing status.

Taxpayers can deduct their entire estimated payment amount on line 31. Income Tax Return for Real Estate Investment Trusts 2021 02082022 Publ 1153. Federal income tax includes the net investment income tax on federal form 8960 and any payments made in 2021 associated with federal section 965 net tax liability.

Income Tax Return for Real Estate Investment Trusts 2021 12202021 Inst 1120-REIT. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Your additional tax would be 1140 038 x 30000.

Subject to a 38 unearned income Medicare contribution. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. In 2013 a new income tax was added the Net Investment Income Tax.

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. Department of the Treasury Internal Revenue Service 99 Net Investment Income Tax Individuals Estates and Trusts. April 8 2021 756 AM.

Future Developments For the latest information about developments related to Form 8960 and its instructions such as legislation. If an individual has income from investments the individual may be subject to net investment income tax. Married Filing Jointly or Qualifying Widow er is 250000.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. All About the Net Investment Income Tax.

The tax only applies if you report net investment income. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. The niit is a 38 additional tax on the lesser of net investment income or the excess of the childs modified adjusted gross income magi over a threshold amount.

This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. If an individual owes the net investment income tax the individual must file form 8960 pdf.

Married Filing Separately is 125000. Attach to your tax return. How to Apply for a Certificate of Subordination of Federal Estate Tax Lien Under Section 6325d3 of the Internal Revenue Code 0618.

The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or modified adjusted gross income. For most US individual tax payers your 2021 federal income tax forms are due on April 18 2022 for income earned January 1 2021 through December 31 2021. SSN ITIN or FEIN.

An additional Medicare tax of 09 also applies to earned income subject to employment taxes discussed in. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. If the amount on your 2021 Federal Form 10401040-SR1040NR line 18 is zero and the Net Investment Income Tax from line 17 202 1 Form 8960 is also zero STOP enter zero on Line 15 below.

Taxpayers use this form to figure the amount of their net investment income tax NIIT. 2021-12-17 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of individuals estates and trusts that exceed statutory threshold amounts. Include state local and foreign income taxes you paid for the tax year that are attributable to net investment income You can determine the portion of your state local and foreign income taxes allocable to net investment income using any reasonable method.

See how much NIIT you owe by completing Form 8960. Individuals who have for the tax year a MAGI thats over an applicable threshold amount and b net investment income must pay 38 of the smaller of a or b as their NIIT. If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT.

According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-income households see Congressional Research Service The 38 Net Investment Income Tax. Printable 2021 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2021 tax tables and instructions for easy one page access. For instructions and the latest information.

What is the Net Investment Income Tax Rate. The Net Investment Income Tax NIIT is actually a Medicare surtax intended to bolster the Medicare tax rolls in order to help pay for the Affordable Care Act. Instructions for Form 1120 REIT US.

We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960 fully updated for tax year 2021. You can print other Federal tax forms here. This tax is an additional tax at the rate of 38 on investment income above certain levels.

The statutory authority for the tax is. California election to include net capital gain tax forms are a summary of California tax TAXABLE YEAR 2021 Investment Interest Expense Deduction CALIFORNIA FORM 3526 Attach to Form 540 Form 540NR or Form 541.

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

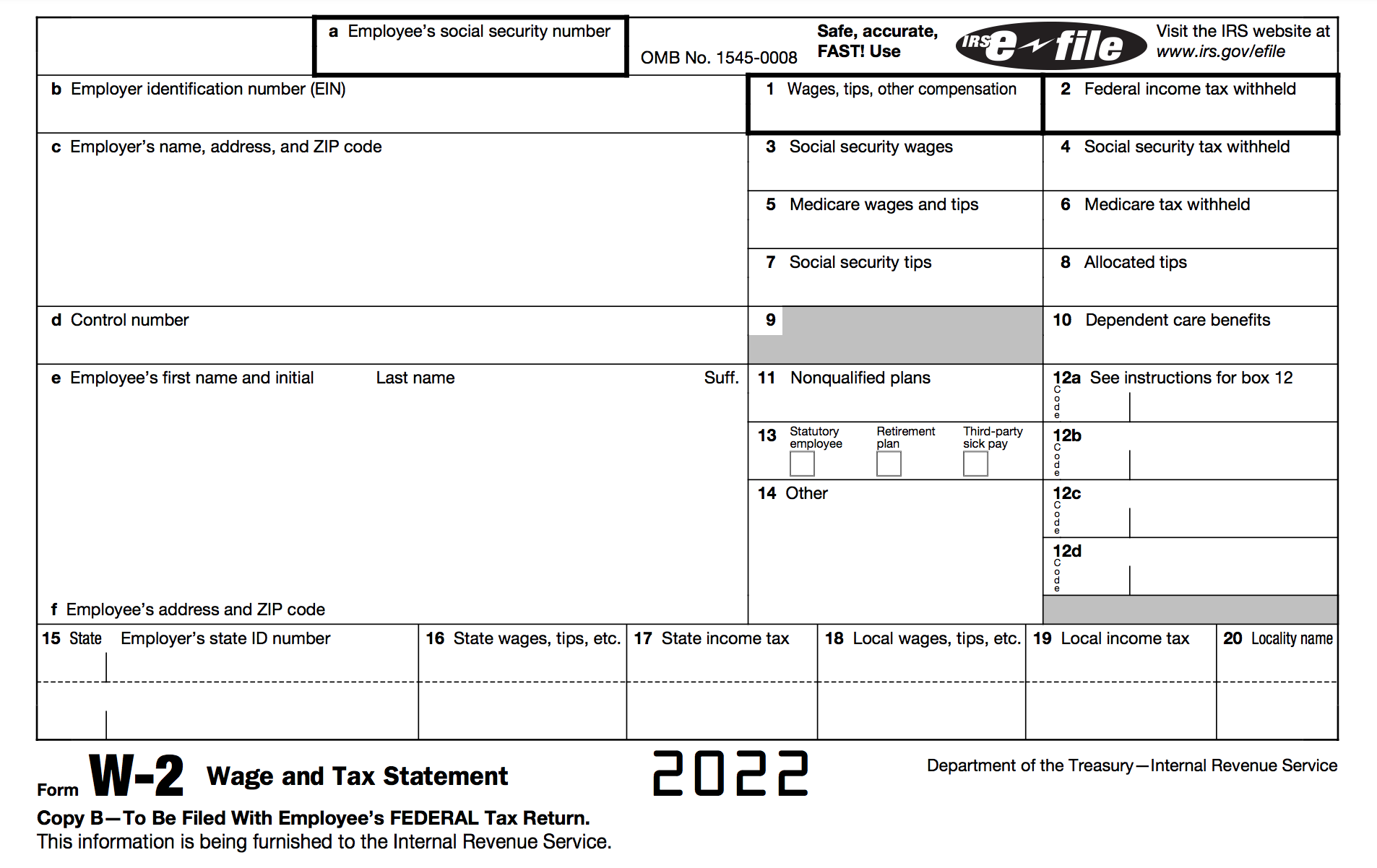

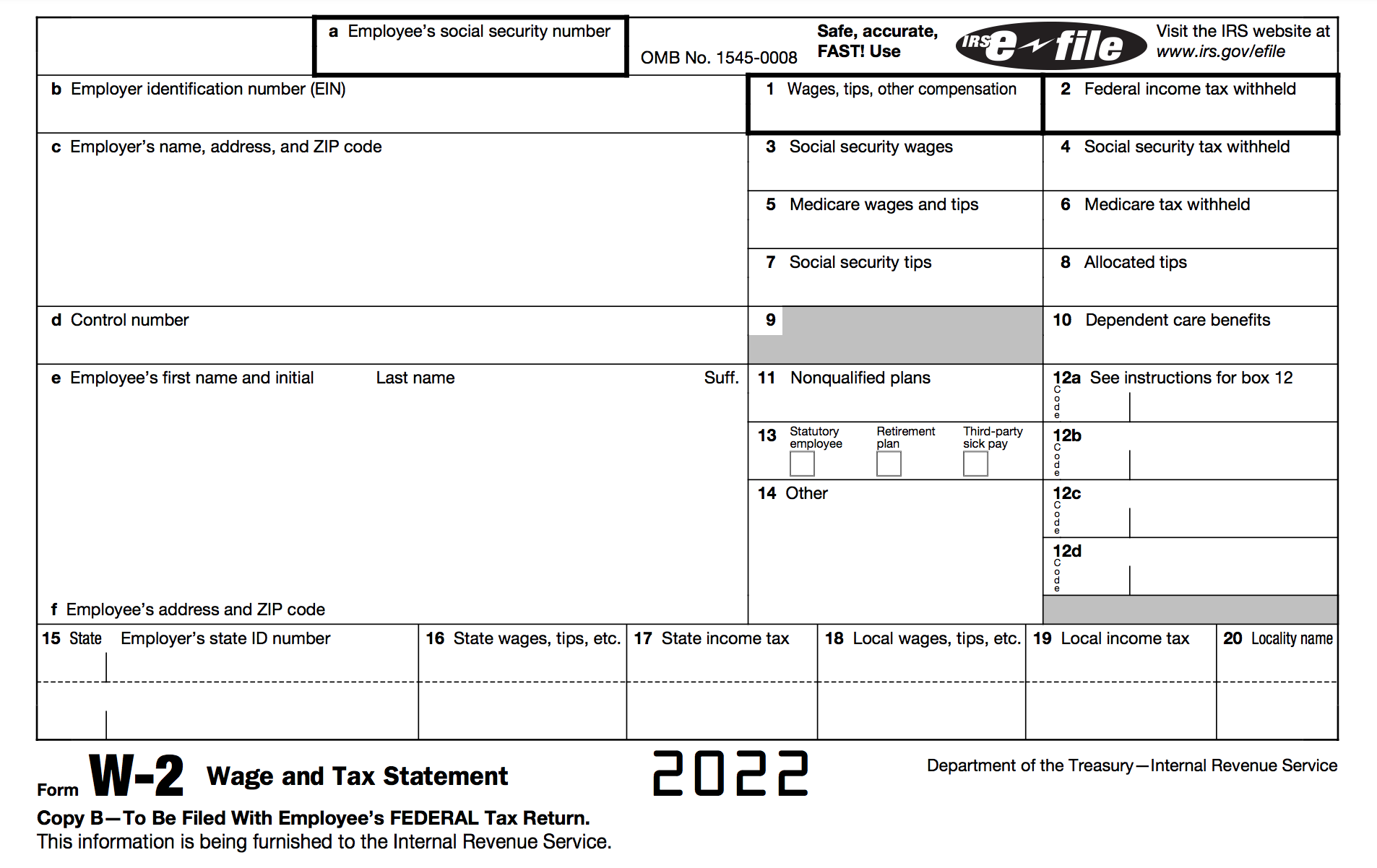

How To Fill Out A W 2 Tax Form For Employees Smartasset

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Irs Tax Return Forms And Schedule For Tax Year 2022

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

How To Read Your 1099 Robinhood

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)