kansas sales tax exemption certificate expiration

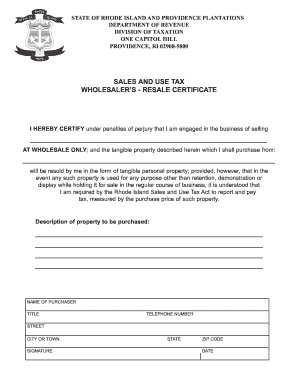

Drop shipped to a Kansas location the out-of-state retailer must provide to the third party vendor a Kansas sales tax registration number either on this certificate or the Multi-Jurisdiction. And Publication KS-1520 Kansas Exemption Certificates.

Sales Taxes In The United States Wikipedia

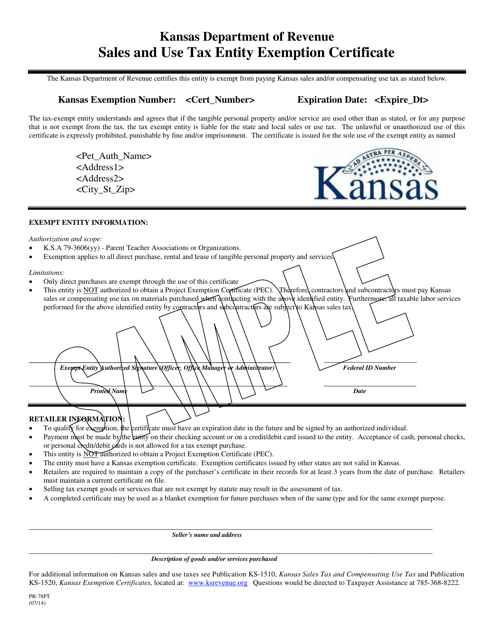

Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number Form PR-78SSTA.

. This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA. In Kansas a resale exemption certificate only needs to be renewed if more than one year takes place between transactions. Tax exemption certificates last for one year in Alabama and Indiana.

Your Kansas Tax Registration Number 000-0000000000-00. For corporations whose business income is solely within state boundaries the tax is 4 of net income. The process is relatively simple.

Do Kansas resale exemption certificates expire. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

For specific questions on this notice or on exemption certificates contact 785 368-8222. Any sales tax-exempt entity that does not have an exemption certificate may apply online at the Kansas Department of Revenues website. In addition net income in excess of 50000 is subject to a 3.

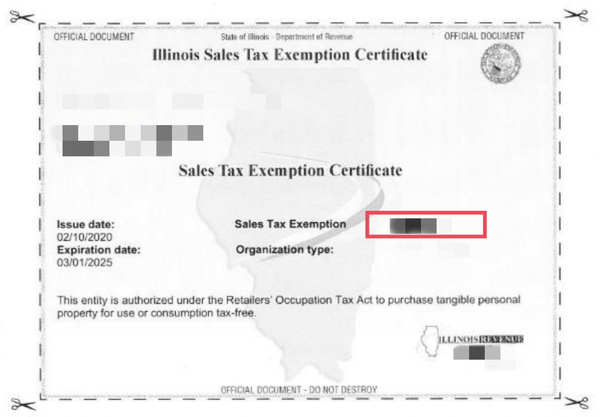

Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. Kansas Exemption Certificates located at. Or Designated or Generic.

Certificates last for five years in at least 9 states. Current Certificate These are. If you are a nonprofit organization that is exempt from paying federal taxes you will need to renew your tax exemption certificate every few years.

The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. Step 1 Begin by downloading the Kansas Resale Exemption Certificate Form ST-28A Step 2 Identify the sellers name business address Sales Tax Registration Number and. The certificates will need.

The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. Does a Kansas Resale Exemption Certificate Expire. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify.

Florida Illinois Kansas Kentucky Maryland Nevada. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose.

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

What Is A Tax Exemption Certificate And Does It Expire Quaderno

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Sales Tax Exemption Renewal Harbor Compliance

Fill Free Fillable Kansas Department Of Revenue Pdf Forms

Rhode Island Resale Certificate Form Fill Out And Sign Printable Pdf Template Signnow

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Free Kansas Bill Of Sale Forms 4 Pdf Eforms

Resale Certificate How To Verify Taxjar

Fill Free Fillable Kansas Department Of Revenue Pdf Forms

Sales Taxes In The United States Wikipedia

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

About Tax Exemption Creality 3d

State By State Guide How To Get A Sales Tax Resale Certificate In Each State Taxvalet

Military Personnel Geary County Ks

Form Ks 1520 Fillable Sales Tax Exemption Information And Certificates